- Home Page

- Seller Services

- Buyer Services

- Neighborhoods

- My Real Estate Blog

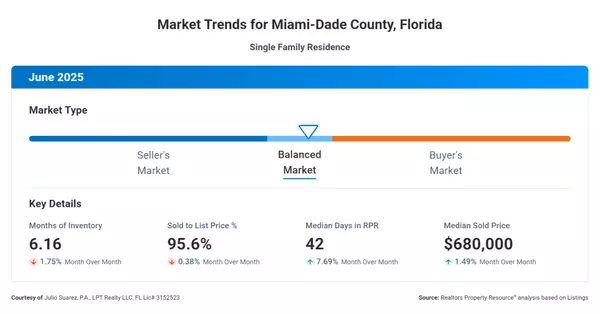

- Market Snapshot

- About The Suarez Team

- MORE

-

- My Homes

- My Tours

- My Favorites

- My Searches

- Sign In

- Register

Miami-Dade Total Home Sales Surge: 2024 Ends on a High Note for the South Florida Real Estate Market

by Julio N. Suarez, PA

Miami-Dade Total Home Sales Surge: 2024 Ends on a High Note for the South Florida Real Estate Market

By Julio N. Suarez, The Suarez Team, LPT Realty

If you’ve been following the Miami real estate headlines, you already know that 2024 ended with a significant surge in total home sales—particularly single-family homes and luxury condos. According to the MIAMI Association of Realtors (MIAMI) and the MIAMI Southeast Florida Multiple Listing Service (SEFMLS), Miami-Dade County saw notable year-over-year gains in single-family home transactions (+9.9%) and $1M+ condo sales (+51%) in December 2024.

For anyone looking to buy or sell in the South Florida real estate market, this upward trend signals plenty of opportunity. Read on to learn why our region remains one of the country’s hottest markets, and discover how you can make the most of it—whether you’re a homeowner thinking about selling or a buyer eager to invest.

A Snapshot of the Miami Real Estate Boom

-

December 2024 Highlights:

- Overall sales rose by 2.9% year-over-year, with single-family homes jumping by 9.9%.

- Luxury condo sales ($1M+) saw a 50.9% increase compared to December 2023.

- Miami single-family homes ended 2024 with 10,738 transactions—1.9% more than 2023.

-

Why the Surge?

- Post-Election Confidence: With election uncertainties behind us, buyers who had been on the fence are now moving forward.

- Strong Demand & Limited Supply: Even with mortgage rates topping 7%, high demand and low inventory keep pushing sales and prices upward.

- Global & Domestic Appeal: Miami continues to attract international buyers seeking both luxury and affordability, while U.S. buyers from pricier markets see more value here.

Miami’s Market Forecast: What 2025 Could Bring

Realtor.com ranks Miami-Fort Lauderdale-Pompano Beach as the No. 2 Top Housing Market in the U.S. for 2025, forecasting a 24% year-over-year increase in sales and a 9% rise in median sale prices. Additionally, CoreLogic data shows Miami placed second in the nation for home-price appreciation as of January 2025.

Why Sell Now?

- Price Appreciation: Miami single-family homes have seen median prices climb for 157 consecutive months—over 13 years of gains. Selling in a market with this kind of growth can yield a substantial return on your investment.

- Limited Inventory: With only 5.2 months of supply for single-family homes, it remains a seller’s market. Reduced competition often translates to faster sales and more favorable terms for sellers.

- High Buyer Demand: From out-of-state relocations to international investors, Miami’s pipeline of buyers is robust. Listing your property now could attract multiple offers, potentially above asking price.

Ready to cash in on these market conditions?

- Call us today at (35) 785-0985 to request a free home valuation.

- Or schedule a consultation with Julio N. Suarez and The Suarez Team at LPT Realty to learn how we can strategically position your home for a successful sale.

Condo Market: Luxury and Affordable Segments on the Rise

While luxury condo sales surged by 50.9% in December 2024, more affordable condos (priced between $150K and $250K) also saw double-digit increases. Median condo prices have risen 126.3% over the past 10 years, and the median now sits at $430,000.

- Inventory Shifts: Miami condo listings grew by 46.4% year-over-year, reaching 11,256 active listings. This is still 23.2% below pre-pandemic levels, meaning there’s room for further market strengthening.

- Financing Challenges: Only 21 condominium buildings in Miami-Dade, Broward, and Palm Beach counties are approved for FHA loans, creating limited financing options for some buyers. Yet, cash sales remain high—especially in the luxury market.

Single-Family Home Market: Consistent Growth

Miami single-family home median sale prices increased by 10.7% year-over-year in December 2024, reaching $675,000. This marks an astounding 175.5% increase since December 2014. Inventory rose by 24.7% to 4,683 active listings, but months’ supply is still only 5.2—signaling it’s a seller’s market.

- Impressive Equity Gains: A home purchased in Q3 2009 and sold in Q3 2024 saw an average equity gain of $542,175—nearly double the U.S. average of $310,232.

- Economic Impact: Each home sale in Florida generates an estimated $123,000 in local economic activity, further strengthening the region’s economy.

Why Buy Now?

- Growing Equity: Miami leads the U.S. in home-price appreciation. Even if mortgage rates are higher than before, strong appreciation and potential future rate drops could offset current interest costs.

- Global Demand = Investment Security: International buyers and domestic relocations keep demand strong. Many owners see Miami as a stable, long-term investment.

- Lifestyle & Affordability: Compared to other global cities like New York, London, or Hong Kong, Miami still offers more space per dollar. A prime property in Miami offers 60 square meters for $1M, far exceeding major international hubs.

Thinking of making Miami your new home or investing in a promising market?

- Call us today at (305) 785-0985 to discuss your buying options.

- Schedule a consultation with the Suarez Team to learn how we can help you navigate the South Florida real estate market.

Inventory Overview: Balancing a Seller’s and Buyer’s Market

- Condo Inventory: At 11.1 months of supply, the condo market is leaning toward buyers.

- Single-Family Inventory: With only 5.2 months of supply, it’s still a seller’s market.

- National Comparison: Nationally, unsold inventory sits at 3.3 months, indicating Miami offers more options for condo buyers compared to the rest of the U.S.—but less for single-family properties.

Mortgage Rates, Cash Sales, and Market Dynamics

- Mortgage Rates: Averaging around 6.96% as of January 2025 (per Freddie Mac), rates are higher than a year ago but have seen slight dips recently. Economists predict an upswing in sales for the second half of 2025 if rates stabilize or fall further.

- Cash Purchases: Comprising 40.4% of December 2024’s Miami sales, cash deals remain a hallmark of this market. Investors and international buyers continue to see Miami as a prime spot to park their funds.

Closing Thoughts: Miami Real Estate Remains an Opportunity

From robust price appreciation to high demand across all segments—single-family homes, condos, affordable units, and luxury properties—Miami real estate offers compelling prospects for both buyers and sellers. Despite challenges like higher mortgage rates and condo financing limitations, the market shows strong resilience and growth potential.

Ready to Make Your Move in the South Florida Real Estate Market?

- Sellers: Call us today at (305) 785-0985 to request a free home valuation and learn how we can help maximize your home’s potential sale price.

- Buyers: Schedule a consultation with The Suarez Team, LPT Realty to explore the best neighborhoods, price points, and investment opportunities. Let us guide you every step of the way.

Contact:

Julio N. Suarez

The Suarez Team, LPT Realty

(305) 785-0985

Start your Miami real estate journey now—and join the many who are discovering why South Florida truly is a premier destination for homeownership and investments.

Recent Posts